Definition of Bootstrapping

The term bootstrapping refers to the technique of carving out a zero-coupon yield curve from the market prices of a set of a coupon paying bonds. The bootstrapping technique is primarily used to make up Treasury bill yields which are offered by the government and as such are not always available at every time period.

Examples of Bootstrapping

Some of the examples of bootstrapping are given below:

Example #1

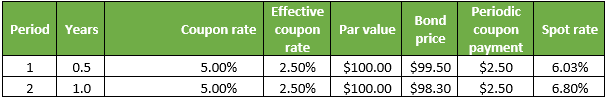

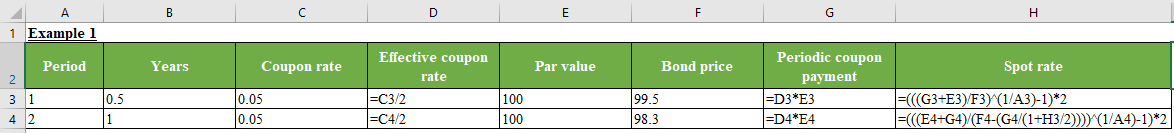

Let us take the example of two 5% coupons paying the bond with zero credit-default risks and a par value of $100 with the clean market prices (exclusive of accrued interest) of $99.50 and $98.30, respectively and having time for the maturity of 6 months and 1 year respectively. First, determine the spot rate for the 6-month and 1-year bonds. Please note that this is a par curve where the coupon rate is equal to the yield to maturity.

At the end of 6 months the bond will pay a coupon of $2.5 (= $100 * 5% / 2) plus the principal amount (= $100) which sums up to $102.50. The bond is trading at $99.50. Therefore, the 6-month spot rate S0.5y can be calculated as,

$99.50 = $102.50 / (1 + S0.5y/2)

- S5y = 6.03%

At the end of another 6 months the bond will pay another coupon of $2.5 (= $100 * 5% / 2) plus the principal amount (= $100) which sums up to $102.50. The bond is trading at $98.30. Therefore, the 1-year spot rate S1y can be calculated using S0.5y as,

$99.50 = $2.50 / (1 + S0.5y/2) + $102.50 / (1 + S1y/2)2

- $99.50 = $2.50 / (1 + 6.03%/2) + $102.50 / (1 + S1y/2)2

- S1y = 6.80%

So, as per the market prices, the spot rate for the first 6-month period is 6.03%, and the forward rate for the second 6-month period is 6.80%

Example #2

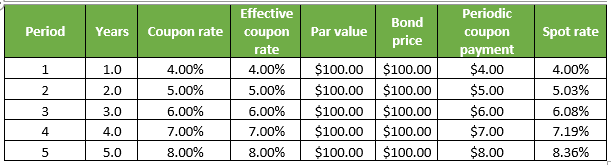

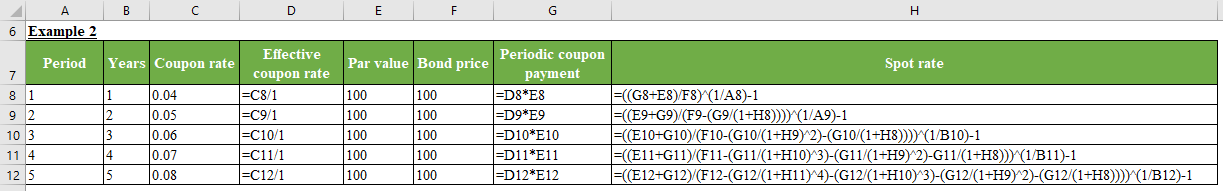

Let us take another example of some coupon-paying bond with zero credit-default risks, with each having a par value of $100 and trading at par value. However, each of them has a varying maturity period that ranges from 1 year to 5 years. Determine the spot rate for all the bonds. Please note that this a par curve where the coupon rate is equal to the yield to maturity. The detail is given in the table below:

1. At the end of 1 year the bond will pay a coupon of $4 (= $100 * 4%) plus the principal amount (= $100) which sums up to $104 while the bond is trading at $100. Therefore, the 1-year spot rate S1y can be calculated as,

$100 = $104 / (1 + S1y)

- S1y = 4.00%

2. At the end of 2nd year the bond will pay coupon of $5 (= $100 * 5%) plus the principal amount (= $100) which sums up to $105 while the bond is trading at $100. Therefore, the 2-year spot rate S2y can be calculated using S1y as,

$100 = $4 / (1 + S1y) + $105 / (1 + S2y)2

- $100 = $4 / (1 + 4.00%) + $105 / (1 + S2y)2

- S1y = 5.03%

3. At the end of 3rd year the bond will pay coupon of $6 (= $100 * 6%) plus the principal amount (= $100) which sums up to $106 while the bond is trading at $100. Therefore, the 3-year spot rate S3y can be calculated using S1y and S2y as,

$100 = $4 / (1 + S1y) + $5 / (1 + S2y)2 + $106 / (1 + S3y)3

- $100 = $4 / (1 + 4.00%) + $5 / (1 + 5.03%)2 + $106 / (1 + S3y)3

- S3y = 6.08%

4. At the end of 4th year the bond will pay coupon of $7 (= $100 * 7%) plus the principal amount (= $100) which sums up to $107 while the bond is trading at $100. Therefore, the 4-year spot rate S4y can be calculated using S1y, S2y and S3y as,

$100 = $4 / (1 + S1y) + $5 / (1 + S2y)2 + $6 / (1 + S3y)3 + $107 / (1 + S4y)4

- $100 = $4 / (1 + 4.00%) + $5 / (1 + 5.03%)2 + $6 / (1 + 6.08%)3 + $107 / (1 + S4y)4

- S4y = 7.19%

5. At the end of 5th year the bond will pay coupon of $8 (= $100 * 8%) plus the principal amount (= $100) which sums up to $108 while the bond is trading at $100. Therefore, the 5-year spot rate S5y can be calculated using S1y, S2y, S3y and S4y as,

$100 = $4 / (1 + S1y) + $5 / (1 + S2y)2 + $6 / (1 + S3y)3 + $7 / (1 + S4y)4 + $108 / (1 + S5y)5

- $100 = $4 / (1 + 4.00%) + $5 / (1 + 5.03%)2 + $6 / (1 + 6.08%)3 + $7 / (1 + 7.19%)4 + $108 / (1 + S5y)5

- S5y = 8.36%

Conclusion – Bootstrapping Examples

The technique of bootstrapping may be a simple one, but determining the real yield curve and then smoothening it out can be a very tedious and complicated activity that involves lengthy mathematics primarily using bond prices, coupon rates, par value and the number of compounding per year.