Boasting the largest economy in the world, the USA provides global organizations access to both a robust customer base as well as the skilled talent necessary to fulfill a company’s business requirements. Multinational companies may find it quite easy to establish U.S.-based operations now, due to recent reductions in trade barriers. Where some get tripped up, however, is in making sense of the complex regulations that govern employment and payroll in the U.S.

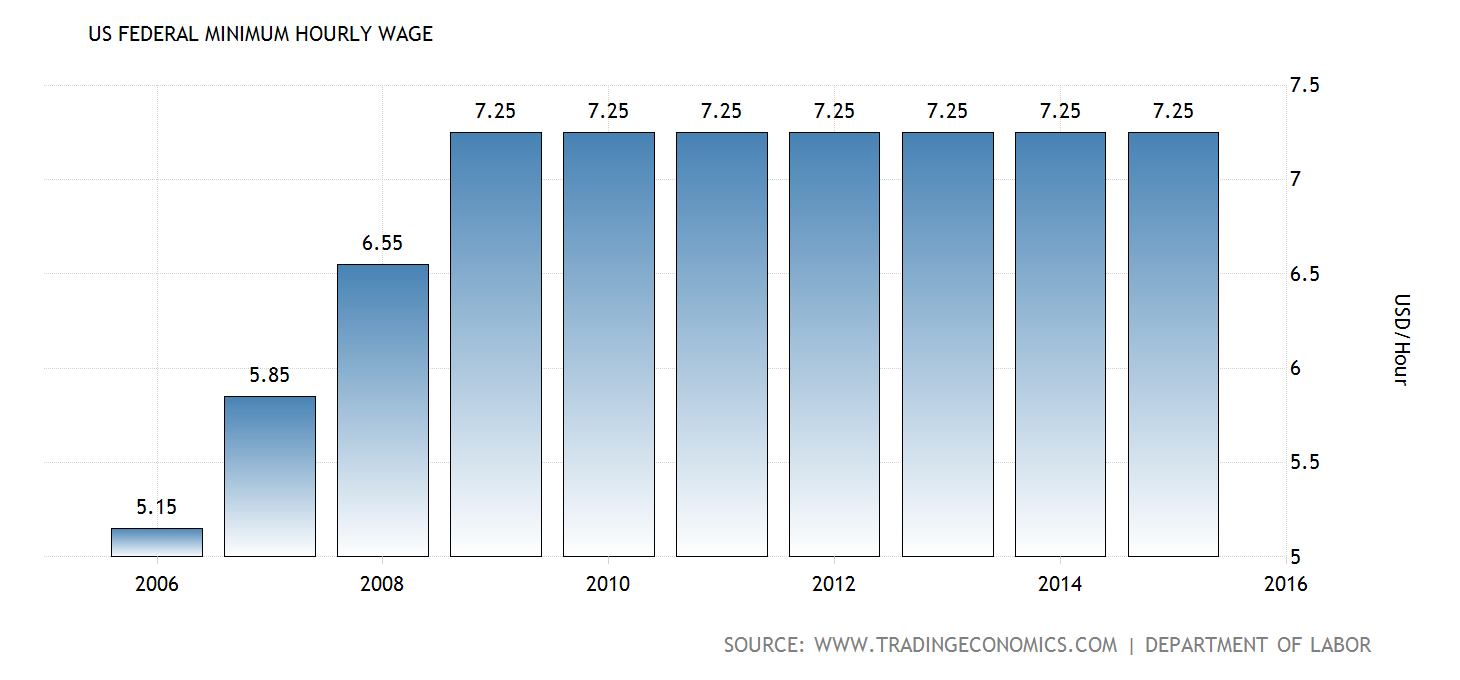

For instance, there are established federal laws along with states and municipality requirements with which employers must comply. The minimum wage debate of 2016 highlights this issue – some states have established minimum wages that are significantly higher than the federal baseline. Employers are expected to follow the local legislation in those instances and companies hoping to take advantage of the business-friendly environment in the United States must have a clear understanding of the complicated payroll and employment laws at local, state and federal levels – or else risk hefty fines for non-compliance.

Let’s explore U.S. employment and compensation laws as well as taxes, social security considerations and medicare withholdings.

Labor Laws

When it comes to employment laws in the U.S., the Fair Labor Standards Act (FLSA) provides guidelines to employers about employment and compensation. As mentioned previously, individual states may opt to establish more rigorous laws that would benefit workers even more. In those cases, employers must follow the state laws instead of those set by FLSA. Additionally, the 10 national holidays recognized in the U.S. are not required by the government to be paid holidays for workers. And, although paid leave time is not mandated by FLSA, the Family Medical Leave Act (FMLA) does dictate that employees must receive up to 12 weeks of unpaid leave for certain medical conditions.

Employee Compensation

Since there is no federal government standard for how frequently employees must be paid, each state (and company) may establish its own laws to guide employers. For instance, most states require that employees who have been terminated must be paid for unused time off if it has been earned or accrued prior to their termination. The employer must establish a stated or written policy for those situations. Federal law does not require termination pay to extend beyond the amount the employee earned during the pay period leading up to their termination.

Income Tax Requirements

Businesses with operations in the U.S. must withhold income tax from their U.S.-based employees. The tax rate, which is established at the federal level on an annual or an as-needed basis, varies depending on income and deductions for a spouse and dependents. For 2016, the tax rates range from 10 percent for lower wage earners to 39.6 percent for the highest earners. Employers are responsible for submitting employee taxes to the Internal Revenue Service (IRS), which is a bureau of the U.S. Department of the Treasury. Employers submit taxes according to the IRS’s deposit schedule, which is based on the employer’s total tax liability for the withholding period.

Additional employer requirements include:

- Filing Form 941 (quarterly reconciliation) at the end of every quarter.

- Filing Form W-3 with the Social Security Administration (SSA) each year.

- Providing all employees with Form W-2, which is the annual wage and tax statement, by January 31 of every year.

In addition, state income taxes must be withheld for most states, as well as Puerto Rico and Washington, D.C. The state exceptions are: Alaska, Florida, Nevada, New Hampshire, South Dakota, Texas, Tennessee, Washington and Wyoming. Additional federal and state unemployment taxes must be paid by the employer under the Federal Unemployment Tax Act (FUTA) and various state unemployment tax laws.

Employer Contributions for Social Security and Medicare (FICA)

The Federal Insurance Contributions Act (FICA) requires U.S. employers to withhold Social Security and Medicare contributions from employee pay checks. Specific contributions are determined by law, and in 2016, employers are required to withhold 1.45% of each employee’s taxable wages for Medicare and 6.2 percent for Social Security. The rates and wage limits are subject to change annually for both Social Security and Medicare withholding. The Social Security taxable wage base limit for 2016 is set at $118,500.00. While there is still no limit to the wages that can be subject to the Medicare tax, which equals 1.45% of all covered wages. Just like we saw in 2015, wages over $200,000 earned in 2016 will face an extra 0.9% Medicare tax, which will be withheld from employees’ wages only (employers are not responsible for this additional tax). Employers operating in the U.S. must provide a matching contribution amount utilizing the same percentage and wage limit as the employee withholding. The employer must then submit the withholding and contribution amount to the IRS based on the employer’s total amount of tax liability for the withholding period via electronic funds transfer (EFT).